unlevered free cash flow vs levered

As you can see the equation for unlevered free cash flow is not nearly as extensive as the one for levered free cash flow. Levered Free Cash Flow.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Levered cash flow is the amount of free cash available to pay dividends the amount of cash available to equity holders after paying debt In some models analysts will use leveraged free cash flows as only.

. Includes interest expense but NOT debt issuances or repayments. Therefore youll find that unlevered free cash flow is higher than levered free cash flow. IRR levered includes the operating risk as well as financial risk due to the use of debt financing.

Unlevered free cash flow is the amount of cash a company has prior to making its debt payments. It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made. Unlevered free cash flow is important to financial health because it highlights the gross cash amount.

Includes interest expense and mandatory debt repayments but opinions on this differ. FCFE EBIT - Taxes. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business.

Unlevered Cash Flow cannot be considered in isolation because it does not incorporate the payments that are to be made to the debt holders. Levered free cash flow is the amount of cash a business has after paying debts and other obligations. The reason for this is that the effects of debt financing have been removed namely interest expense the tax shield ie savings from interest being tax-deductible and principal.

Leverage is another name for debt and if cash flows are levered that means they are net of interest payments. Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another. FCFE Free Cash Flow to Equity Levered Free Cash Flow LFCF The value of a company if all debt was paid off.

99 of the time you care about Unlevered FCF which is good. In case the financing structure or interest rate changes IRR levered will change as well whereas the IRR unlevered stays the same. Used to value equity with a Cost of Equity discount rate only if there are no bondholders andor preferred shareholders FCFF Free Cash Flow to Firm Unlevered Free Cash Flow UFCF The value of the entire firm or enterprise.

I invite you to subscribe to my YouTube channel at the link below. The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company. It is also thought of as cash flow after a firm has met its financial obligations.

Levered free cash flow assumes the business has debts and uses borrowed capital. Unlevered cash flow is the amount of cash that a property produces before taking into account the impact of loan payments. Unlevered Free Cash Flow.

Levered free cash flow is the amount of capital a company has remaining after accounting for payments to settle financial obligations short and long term including principal repayments. It is also referred to as levered cash flow and abbreviated as LFCF. UFCF EBITDA CAPEX working capital taxes.

Free Cash Flow to Equity FCFE Definition. Cash Flow from Operations CapEx. Unlevered Free Cash Flow is the money that is available to pay to the shareholders as well as the debtors.

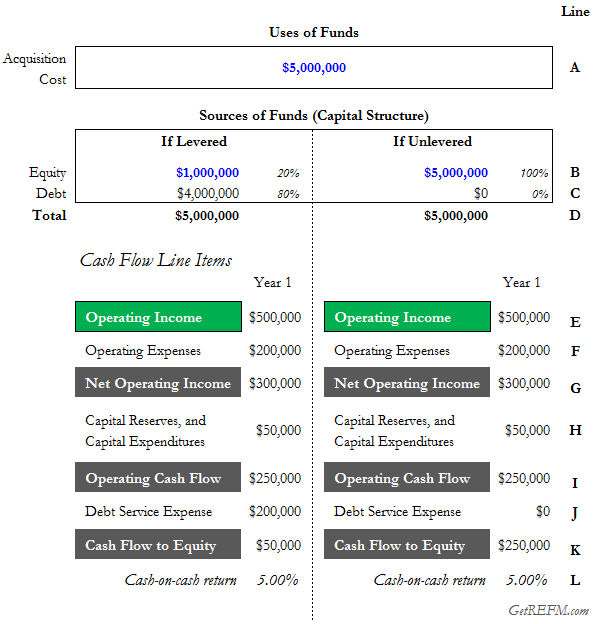

The most important application of these concepts is when calculating return metrics like cash on cash. Unlevered free cash flow is used in both DCF valuations and debt capacity analysis and represents the total cash generated for both debt and equity holders. The key difference between Unlevered Free Cash Flow and Levered Free Cash Flow is that Unlevered Free Cash Flow excludes the impact of interest expense Interest Expense Interest expense arises out of a company that finances through debt or capital leases.

Levered Free Cash Flow is considered to be an important metric from the perspective of the investors. The first step is to decide which kind of Free Cash Flow you need. Free Cash Flow to Equity While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for the cash flow that is available to just equity investors.

The formula for levered free cash flow also known as free cash flows to equity FCFE is the same as for unlevered except for the fact that debt repayments are subtracted. If all debt-related items were removed from our model then the unlevered and levered FCF yields would both come out to 115. While unlevered free cash flow excludes debts levered free cash flow includes them.

The difference between levered and unlevered FCF is that levered free cash flow LFCF subtracts debt and interest from total cash whereas unlevered free cash flow UFCF leaves it in such that LFCF Net Profit DA ΔNWC CAPEX Debt and UFCF EBIT 1-tax rate DA ΔNWC CAPEX. Excludes interest expense and ALL debt issuances and repayments. Levered free cash flow on the other hand works in favor of the business that didnt borrow any capital and doesnt necessarily show a comparative analysis of each companys ability to generate cash flow on an ongoing basis.

Thats because the levered free cash flows equation subtracts debt and equity to yield operating cash only while unlevered free cash flows do not. Unlevered free cash flow is the gross free cash flow generated by a company. This is because a business is liable for paying its debts and expenses in order to generate a profit.

Unlevered IRR accretion and dilution and DCF analysis Advanced Discounted Free Cash Flow and Value Drivers - Financial theory and basis for DCF model - Development of assumptions through considering industry structure growth potential pricing strategy capital expenditure costs and fixed versus variable operating costs. Unlevered FCF Free Cash Flow to Firm which excludes net interest expense and mandatory debt repayments or Levered FCF Free Cash Flow to Equity which includes net interest expense and mandatory debt repayments. What is Levered Free Cash Flow.

Its a better indicator of financial health. Levered cash flow is the amount of cash that a property produces after operating expenses and debt service. About Vs Levered Irr Unlevered.

In our previous post we discussed the meaning and calculation of free cash flow to firm FCFF which is often referred to as unlevered free cash flow. Levered free cash flow is often considered more important for determining actual profitability.

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

Unlevered Free Cash Flow Ufcf Lumovest

Unlevered Free Cash Flow Definition Examples Formula

Understanding Levered Vs Unlevered Free Cash Flow

Understanding Unlevered Cash Flows In Real Estate Top Shelf Models

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

Levered Vs Unlevered Free Cash Flow Difference Wall Street Oasis